Federal Cooperative Credit Union: Your Entrance to Financial Success

By supplying customized monetary options and academic resources, Federal Credit rating Unions pave the way for their participants to reach their economic objectives. Sign up with the conversation to discover the essential advantages that make Federal Credit scores Unions the gateway to financial success.

Benefits of Signing Up With a Federal Lending Institution

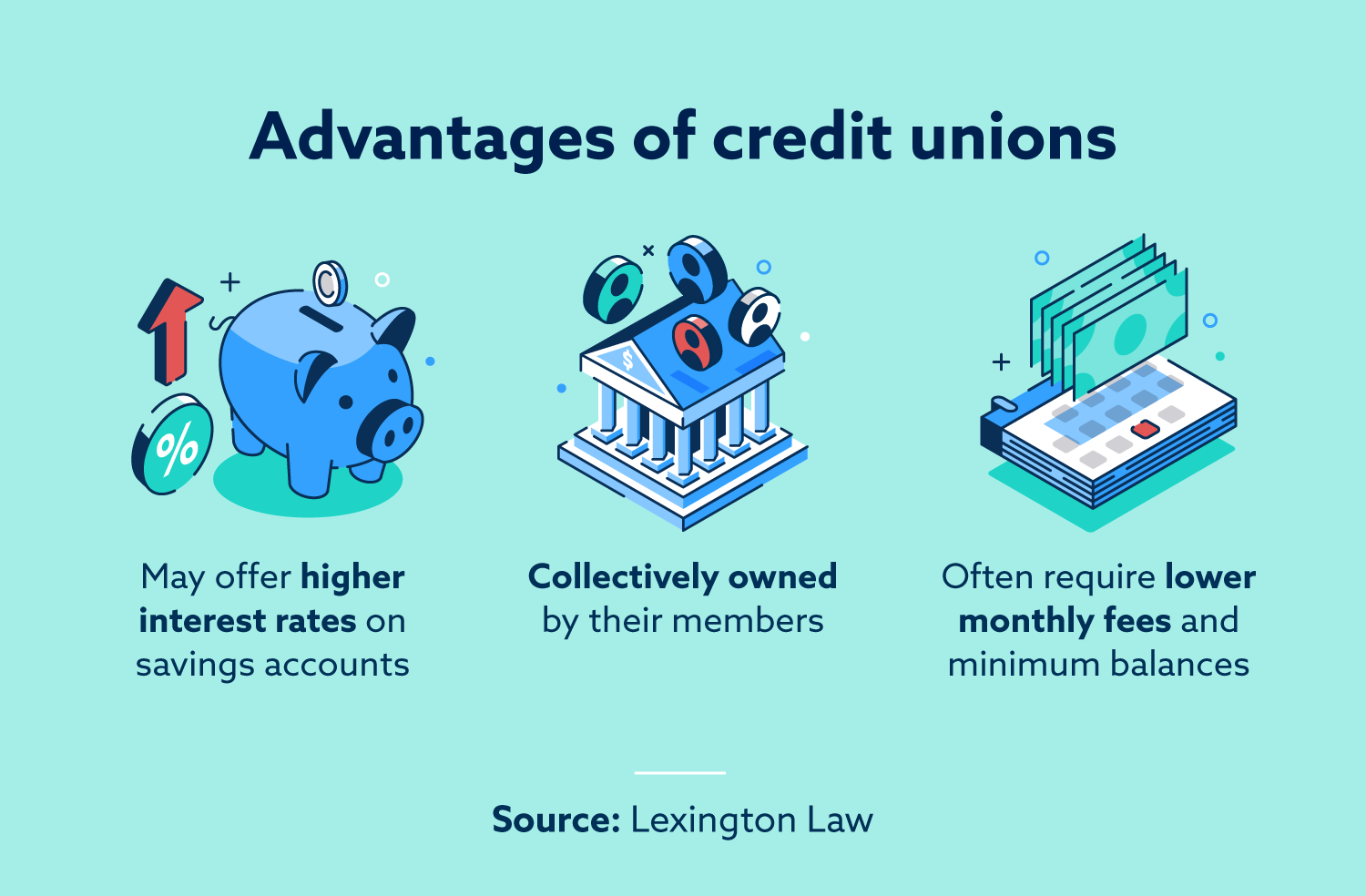

Signing Up With a Federal Credit history Union supplies numerous advantages that can substantially boost your financial wellness. Federal Credit rating Unions are not-for-profit organizations, so they often have reduced overhead expenses, allowing them to pass on these financial savings to their participants in the form of minimized costs for solutions such as examining accounts, car loans, and debt cards.

An additional benefit of joining a Federal Credit rating Union is the customized service that participants get - Wyoming Federal Credit Union. Unlike large financial institutions, Federal Cooperative credit union are understood for their community-oriented method, where members are dealt with as valued individuals instead than simply an account number. This customized solution commonly equates right into more customized monetary solutions and a far better total financial experience for members

Variety of Financial Services Supplied

Federal Credit scores Unions offer a comprehensive array of monetary services made to cater to the diverse demands of their members. These institutions focus on monetary education and learning by providing workshops, seminars, and on-line sources to equip participants with the understanding needed to make informed monetary choices. By supplying this wide variety of services, Federal Credit history Unions play a vital function in supporting their participants' economic wellness.

Competitive Prices and Personalized Solution

In the realm of financial solutions supplied by Federal Cooperative credit union, one standout element is their commitment to supplying affordable prices and personalized solution to guarantee participants' contentment. Federal Credit Unions strive to offer their members with rates that are commonly a lot more positive than those provided by standard financial institutions. These competitive prices include various monetary items, consisting of savings accounts, financings, and credit history cards. By supplying competitive rates, Federal Debt Unions assist their participants save cash on rate of interest settlements and earn more on their deposits.

Exclusive Conveniences for Participants

Members of Federal Credit score Unions acquire access to a variety of special advantages developed to boost their economic health and total financial experience. Federal Credit scores Union participants likewise have access to individualized monetary guidance and support in creating spending plans or taking care of debt.

Additionally, Federal click to investigate Cooperative credit union frequently provide benefits such as reduced rates on insurance policy items, credit scores monitoring solutions, and identity burglary defense. Some cooperative credit union even offer special member price cuts on local events, destinations, or services. By ending up being a participant of a Federal Lending institution, people can enjoy these unique advantages that are customized to assist them conserve cash, build riches, and my blog accomplish their economic goals.

Achieving Financial Goals With Federal Cooperative Credit Union

Credit report unions serve as indispensable companions in helping individuals accomplish their economic goals via customized financial services and individualized guidance. One essential aspect of accomplishing financial objectives with government credit rating unions is the emphasis on member education and learning.

Furthermore, federal lending institution give a wide variety of services and products designed to sustain participants in reaching their financial milestones. From competitive financial savings accounts and low-interest lendings to retirement preparation and financial investment chances, cooperative credit union provide extensive solutions to resolve varied financial demands. By leveraging these offerings, participants can develop a solid financial foundation and job in the direction of their long-lasting purposes.

Moreover, government cooperative credit union often have a community-oriented technique, cultivating a sense of belonging and assistance among members. This public aspect can additionally encourage individuals to remain devoted to their financial goals and celebrate their achievements with similar peers. Inevitably, partnering with a federal cooperative credit union can considerably improve a person's journey in the direction of economic success.

Final Thought

To conclude, government credit unions supply a range of monetary solutions and benefits that can assist people attain their economic objectives. With competitive rates, customized solution, and special participant advantages, these not-for-profit companies work as a gateway to monetary success. By focusing on participant education and learning and area participation, government lending institution empower individuals on their journey towards financial security and success.

By providing customized educational resources and financial solutions, Federal Credit history Unions lead the method for their participants to reach their monetary goals. These organizations prioritize monetary education by providing workshops, seminars, and online resources to empower participants with the expertise required to make enlightened monetary decisions. Whether it's applying for a car loan, setting up a savings plan, or looking for economic recommendations, participants can expect tailored solution that prioritizes their monetary well-being.